The ultimate beneficiaries of the reforms process and the resultant competitive insurance market should be the Indian public. Delivering 4th Convocation address at the ‘National Insurance Academy School of Management, Pune (Maharashtra)’, he said that the Insurance is slowly moving beyond tax incentives and statutory insurance requirements towards becoming an effective risk mitigation instrument. The success of the transition and reaping of the fruits of insurance depends on the efficacy of regulation and timely innovation to cater to real needs of our citizens.

The Vice President expressed his concern that the current agricultural insurance schemes suffer from low coverage and high claims-to-premium ratio. There is an urgent need to seriously consider some proposals including coverage of pre-sowing and post-harvest risks and effecting a transition to actuarial rates and upfront subsidy payments by the Government which will enable timely claim payments. Sustainable agricultural growth and improvement in agricultural technology and productivity would not be possible without reliable risk cover for our farmers.

He said that the success of the transition and reaping of the fruits of insurance depends on the efficacy of regulation and timely innovation to cater to real needs of our citizens. He hoped that the students graduating today, and those benefiting by the training provided by the National Insurance Academy, would contribute to the development of a vibrant insurance market in the country.

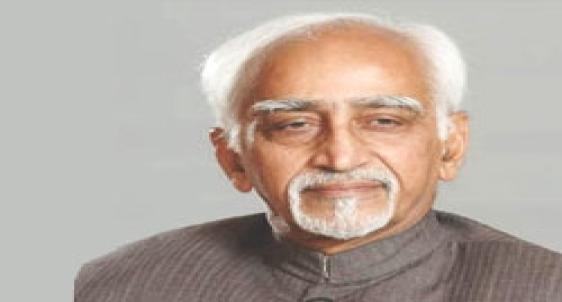

Said Shri M. Hamid Ansari, “Since times immemorial, the human race had to deal with uncertainties. The insurance sector reform undertaken since 2000 has opened up the sector for private participation, provided a developmental and regulatory mechanism for the sector, and led to de-tariffing of general insurance. It has led to an unprecedented growth in the sector. In the seven year period since 2000, the life insurance sector had a compound annual growth rate of 42 per cent. As a result, Insurance Penetration in the country more than doubled and increased from 1.93 per cent in 1999 to 4.7 per cent in 2007. Yet, it is still far short of the Asian average of 6.2 per cent and the global average of 7.5 per cent.”