While the year 2019 will bring with it formation of new Government after the elections in April 2019, the after effects of Demonetization that happened on November 8, 2016 still haunt the Indian Economy. After more than 2 years of Demonetization, Indian Economic Survey claims that the economy has done away with all the negative impacts of Demonetization. However, economic experts are of the view that the economy is still crying for a faster growth and little objective has been achieved by the demonetization move.

Demonetization: Still Haunts Indian Economy

The Demonetization was announced as a surprise in the night on November 8, 2016. The Economic Survey of India which was released just before the presentation of General Budget 2018 in Parliament emphasized that all the negative impact of Demonetization of Rs.500/- and Rs.1000/- currency notes has ended. However, the analysis in India and abroad has claimed that demonetization of November 2016 has failed to do what it was supposed to do and its impact has turned out to be more protracted than initially expected.

Experts think that even from the point of view of promoting digital money, there was no need for the government to have put 86 per cent of all currency out of circulation. Studies have pointed out that very little black money was caught. On August 30, 2017, the Reserve Bank of India released its report on Demonetisation. The report said 99 per cent of the banned notes came back into the banking system. This belies the Government claims that the Demonetization would flush out the black money and counterfeit currency. Claiming the Demonetization as a wrong decision, as 99 per cent currency is back in the system, it points to one of the two things -

Either the black money held in cash was very low, or The government could not implement the demonetization efficiently due to which all the black money held in Rs. 500 and Rs. 1000 bank notes laundered back to the banking system.

Demonetization: Positive Impacts on Indian Economy Claimed

Economic Survey after careful review of Demonetization which was announced one and a half year back, has found that the cash-to-GDP ratio has stabilized. It suggests a return to equilibrium:

- The Economic Survey says that India's GDP is set to grow at 7 to 7.5 percent in 2018-19. This is an increase from its prediction of 6.75 percent growth this fiscal year.

- The Economic Survey has cited exports and imports data to claim that the demonetisation effect was now over. It claims that re-acceleration of export growth to 13.6 percent in the third quarter of Financial Year 2018 and deceleration of import growth to 13.1 percent is in line with global trends. This suggests that the demonetization and GST effects are receding. Services export and private remittances are also rebounding

- According to the statistics released in the Survey, the Demonetization had led to Rs 2.8 lakh crores less cash (Equivalent to 1.8% of GDP) and Rs 3.8 lakh crores less high denomination notes (Equivalent to 2.5% of GDP) in the Indian economy.

- The Economic Survey has also clarified that income tax collections have touched new high with demonetization and introduction of GST, “From about 2 percent of GDP between 2013-14 and 2015-16, they are likely to rise to 2.3 percent of GDP in 2017-18, a historic high.”

|

Group Discussion Topics & Tips: Learn the Facts

|

Demonetization: Back ground and key facts

- On November 8, 2016, the Prime Minister of India, Narendra Modi announced the Demonetization of all Rs.500 and Rs. 1,000 denominationbanknotes of the Mahatma Gandhi Series.

- The demonetization announcement made the use of Rs.500 and Rs.1000 banknotes invalid past midnight of November 8.

- It was also announced that the new Rs.500 and Rs.2000 banknotes of the Mahatma Gandhi new series would be introduced in exchange for the old banknotes.

- The objective of demonetization as claimed by Government of India was to curtail the black money running as shadow economy and to stop the use of counterfeit cash to fund illegal activity and terrorism.

- The sudden nature of the announcement—and the prolonged cash shortages in the weeks that followed—created significant disruption throughout the economy, threatening economic output.

- The demonetization move was heavily criticized as poorly planned and unfair, and was met with protests, litigation, and strikes.

The announcement was sudden and unscheduled. It was a live television address at 8PM on November 8, 2016. In the days following the demonetisation, the country faced severe cash shortages with severe detrimental effects across the economy. People seeking to exchange their bank notes had to stand in lengthy queues, and several deaths were linked to the inconveniences caused due to the rush to exchange cash. As the cash shortages grew in the weeks following the move, the demonetization was heavily criticised by prominent economists and by world media.

Merits-Demonetization Favoured India’s Economic Growth

- Demonetization policy of the Government has been termed as the greatest financial reform that aimed to curb the black money, corruption and counterfeit currency notes.

- All the people who are not involved in malpractices welcomed the demonetization as the right move.

- Demonetization was done to help India to become corruption-free as it will be difficult now to keep the unaccounted cash.

- Demonetization will help the government to track the black money and the unaccounted cash will now flow no more and the amount collected by means of tax can be better utilized for the public welfare and development schemes.

- One of the biggest achievements of demonetization has been seen in the drastic curb of terrorist activities as it has stopped the funding the terrorism which used to get a boost due to inflow of unaccounted cash and fake currency in large volume.

- Money laundering will eventually come to halt as the activity can easily be tracked and the money can be seized by the authorities.

- Demonetization aimed to stop the running of parallel economy due to circulation of fake currency as the banning of Rs.500 and Rs. 1000 notes will eliminate their circulation.

- The unaccounted cash could be deposited in the Pradhan Mantri Garib Kalyan Yojana after paying 50% tax. The money will remain deposited for 4 years with the bank without incurring any interest. However, after 4 years the amount will be returned. This amount can be utilized for social welfare schemes and making the life of low income groups better.

- The Public Sector Banks which were reeling under deposit crunch and were running short of funds have suddenly swelled with lot of money which can be used for future finances and loans after keeping a certain amount of reserve as per RBI guidelines.

- The people who opened the Jan Dhan accounts will now use their accounts and become familiar with banking activitiy. The money deposited in these accounts can be used for the developmental activity of the country.

- The tax collected due to launch of demonetization policy will be put to developmental activities in the country.

- Demonetization has driven the country towards a cashless society. Lakhs of the people even in remote rural areas have started resorting to use the cashless transactions. The move has promoted banking activities. Now even the small transactions have started going through banking channels and the small savings have turned into a huge national asset.

- The high rising price pattern and inflationary trends which the Indian economy was facing are taking a down turn making the living possible within low income group reach.

Demerits-Blow to economic growth and inconvenience all around

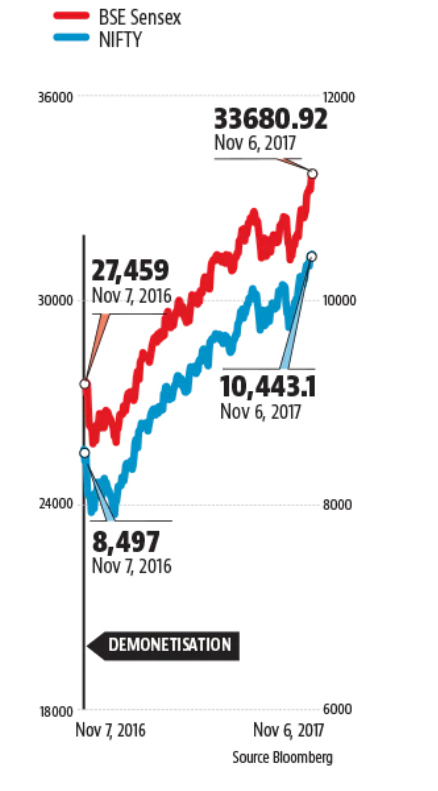

The very next day of announcing the demonetization, the BSE Sensex and NIFTY 50 stock indices fell over 6%. The severe cash shortages brought detrimental impact on the economy. People trying to exchange their bank notes had to stand in lengthy queues causing many deaths due to inconvenience and rush.

- The sudden announcement has made adverse impact on business and economy. Instead of a growing economy India has become a standstill and no growth economy. It is fearedthat a fall of 2-3% in the GDP growth will be recorded coming year.

- India is an agriculture based economy. Due to the cash crunch, the farmers especially small and marginal who largely depend on cash to buy seeds, fertilizers and to pay for sowing, borrowing water for irrigation and for other related agriculture equipments remained worst affected and could not complete the crop related activity.

- Since small branches of the banks were also not supplied with adequate cash within time of sowing season of the crop, farmers could not get their crop loans disbursed. This added to the woes of the farmers leading to a weak agriculture production the coming year.

- Real Estate sector came to a stand still and is still gasping for buyers of the constructed and half constructed inventory without buyers. This has resulted in poor cash flow leading to a poor demand.

- Demonetization has made the situation become chaotic. Tempers are running high among the masses as there is a delay in the circulation of new currency.

- Due to the inability to pay cash to poor daily wage workers, the small employers have stopped their business activity.

- The poor planning on the part of the government has also added to the woes of the common people with low incomes. The Rs.2000 currency note does not find many takers as it is difficult to get the balance back when you are buying daily needs like vegetables, milk, bread or paying for petty expenses like bus fare. While rs.100 currency notes were not available in sufficient number, Rs.500 note arrived in the market very late.

- Demonetization is the 2 way sword in regard to incurring the public expenditure. On the one hand huge cost is to be incurred on printing the new currency and on the other hand managing the lakhs of crores of old currency volume has also become a big expenditure incurring item.

- Many Economists are of the view that Rs.2000 currency note will be much easier to hide and can be used to store black money in shorter space.

- Entire opposition has stood against demonetization and has called this decision a draconian law.

Demonetisation: Success points

India has marched on the path of digital transactions at a much faster pace. Key points describing success of demonetisation are:

Rate of Inflation goes down

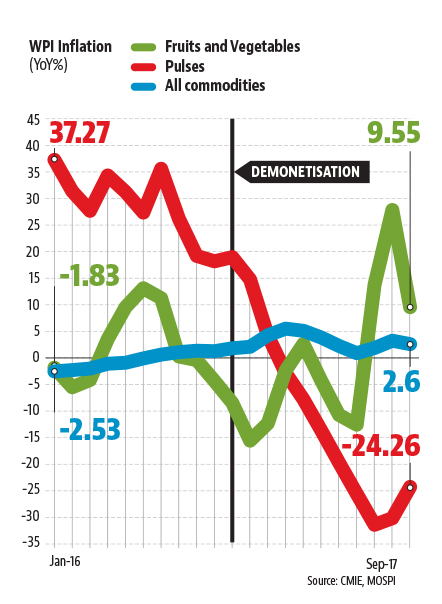

Prices of commonly consumed commodities like Pulses, fruits, vegetables had gone down substantially post demonetization. Accordingly it brought down the rate of inflation during the months that followed demonetization. The chart below represents the impact of demonization on the commodities

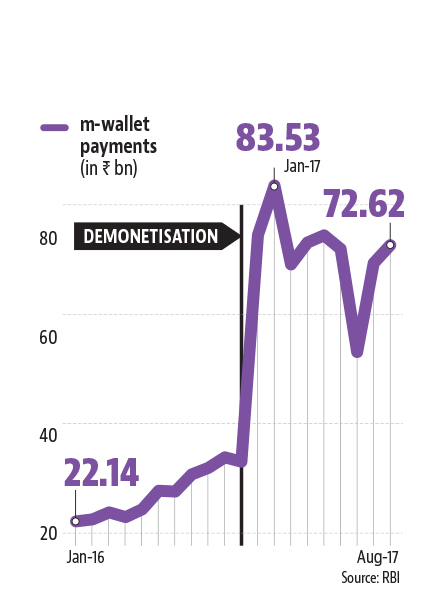

India moves to cashless economy

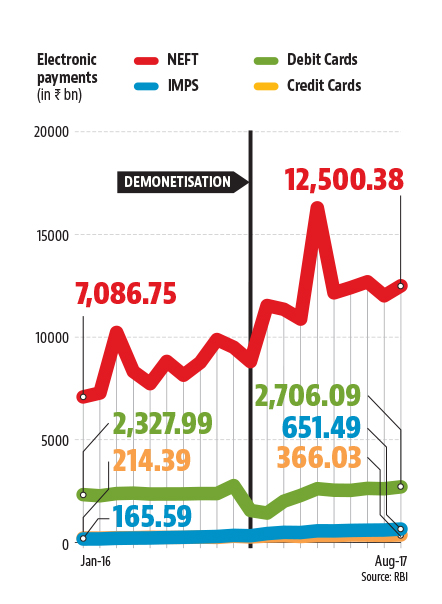

One of the key effects of Demonetization 2016 has been that more people have made digital payments part of their lives moving towards a cashless economy. The details of growth of such digital transactions since January 2016 to August 2017 reflect that NEFT transactions that involved Rs. 7086 bn increased to Rs.12500 bn; Debit cards transactions increased from Rs.2328 bn to Rs. 2700 bn; credit cards from Rs. 214 bn to Rs.366bn and the IMPS transaction which was not used by the people, got a share of Rs.651 bn. The Data shared by Reserve Bank of India reflect the trend:

Stock Market gets bullish

After demonetization stock market in India got bullish. While BSE index which was 27, 459 on November 7, 2016 rose to 33680.92 on November 6, 2017, the NSE rose from 8497 to 10,443. The data shared by Bloomberg reflect the trend.

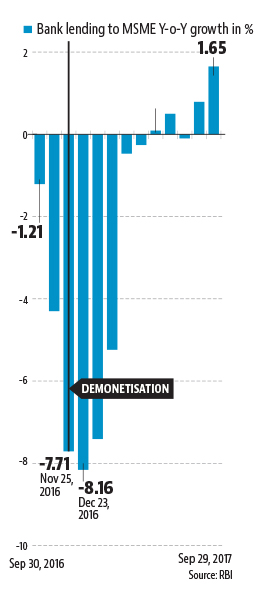

Banks’ lending increases for small businesses

Banks’ finance to small business was going down in pre-demonetization period. There was a negative growth even in short period of months. As on November 25, 2016, a negative growth of -7.71% was recorded in Banks’ lending to small business. It went to -8.16% as on December 23, 2016. However, as on September 29, 2017 the Reserve Bank of India has reported a positive growth of 1.65% in lending to small business by the Banks.

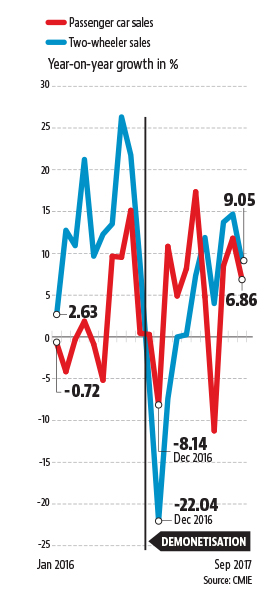

Automobile sales picked up

Sale of 2 wheelers and 4 wheelers was showing a negative growth in 2016. In 2017 it went up substantially and recovered from the impact of negative growth to high positive growth as reflected in the report.

More people use Mobile wallets than cash

Instead of using cash, more people have started using Mobile wallets for making payments for their regular needs. Even less educated people have learned and switched over to mobile transactions. The volume of transactions which was Rs.22.14 bn in January 2016, had gone up to Rs. 83.53bn in January 2017.

Failures of Demonetization

Economic Growth slows down

Post demonetization growth of Indian Economy slowed down from 9.1% to 5.7% in less than one year. Month-wise GDP growth chart for the period March 2016 to September 2017 as shared by Bloomberg emphasizes this fact as detailed below:

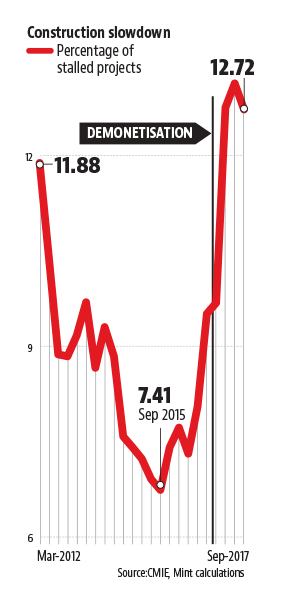

Realty sector bears the brunt

The triple decisions of demonetisation, RERA and GST resulted in a deceleration of new property launches. The supply of new housing units in the top-6 cities in India during the first three quarters of 2017 was down by around 60 per cent, compared with the corresponding period of 2016.

With respect to property sales, the secondary market was obviously highly susceptible to demonetisation as compared to the primary market. Property transactions in the secondary sales and luxury housing segments tended to have significant cash components, and such sales have been hampered significantly due to demonetization.

However, the shadow of Demonetization now appears to be fading in reality sector. The prevailing attractive home loan rates, flexible payment plans and other attractive offers by developers, coupled with restricted new supply addition, has led to a steady decline in the unsold inventory.

As of Q3 2017, only 6,38,500 units remained unsold in the top-6 cities, registering a 9 per cent decline from Q4 2016 levels. The demand for affordable and mid-segment housing has been on a rise.

Initiatives such as interest waivers on home loans, the government’s push for affordable housing through Pradhan Mantri Awas Yojana (PMAY) and the ‘Housing for all by 2022’ mission have come to the forefront over the past one year. Various policy initiatives, amendments and reforms were all aimed at making the real estate sector more transparent, organised and fundamentally stronger. Demonetisation played a significant role in this process.

In the long term, the real estate sector is likely to regain a faster growth trajectory and is estimated to contribute around 13 per cent to India’s gross domestic product by 2028. This optimistic forecast is very much attainable because the various reforms now redefining the realty landscape in India will not only incrementally boost consumer sentiment but also improve investment inflows from foreign and domestic institutional investors.

The Finance Minister Arun Jaitley on November 7, 2017 came out with a spirited defence of demonetisation announcement on November 8, 2016 calling it a “watershed moment for the Indian economy”. According to him the demonetization has not only changed the agenda but also made corruption difficult. Thus, in his opinion, it was not only a “morally and ethically correct” step but also “politically correct”.

Which way to go?

You may get not more than 1 minute while speaking for or against or taking a balanced view on demonetization and its impact on economy. The only thing is that you should be well aware about the topic and only this can lead you to speak the way you think is right. Besides, once someone else is speaking you may carefully listen to him and later try to get in and speak out your view point. Please remember do not criss-cross your own stand.